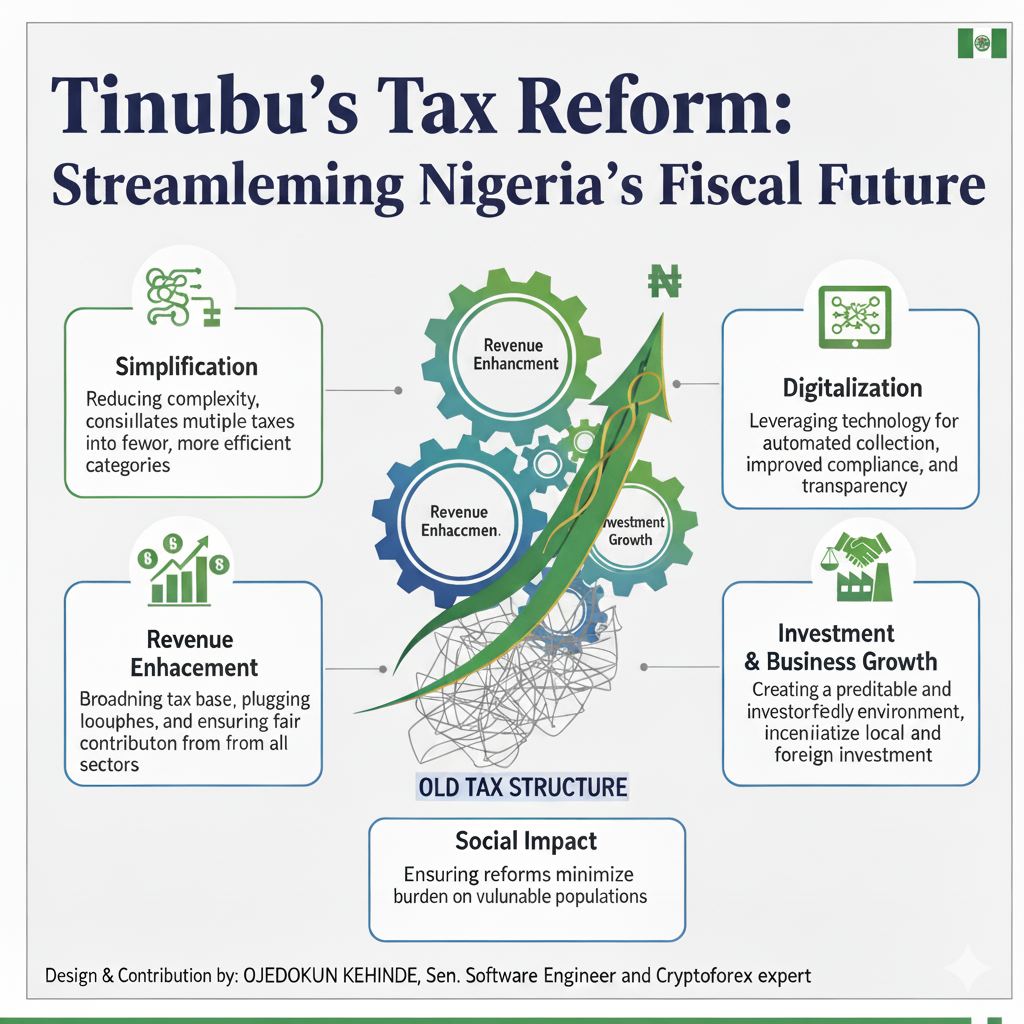

When President Bola Ahmed Tinubu’s administration rolled out the new tax reform policy, most Nigerians brushed it aside. But as the details are unfolding, one thing is clear: this reform is going to touch everyone, whether you’re a wealthy man tucked away in a remote village or an average worker hustling in the city.This is not one of those policies you can ignore. 2026 has already been marked as the year of serious tax accountability.Why Tax Reform?For too long, Nigeria has leaned heavily on oil revenue while letting gaps in the tax system widen. The result? A handful of people carry the burden while many slip through unnoticed. The Tinubu reform is meant to change that. It’s here to:Widen the tax net so more people and businesses are captured.Monitor inflows into accounts through Tax IDs.Provide the government with revenue to fund schools, roads, hospitals, and development projects.The Hard Truth Nigerians Must FaceLet’s be honest—people don’t like paying tax in Nigeria. And it’s not without reason. Citizens complain: “Why pay when there’s no light, no water, and bad roads everywhere?”But here’s the reality: the new system does not send anybody papa. Whether you think the government is working or not, the law will be enforced. Wealthy men in villages who have been dodging the system will feel it too. The reform is designed to close those escape routes.How the System Will Work in 2026The lifeline of this policy is the Tax Identification Number (TIN). From 2026:Individuals: Your National Identification Number (NIN) will automatically serve as your Tax ID.Business Owners: Your CAC registration number will generate your Tax ID.No Tax ID, no banking. You won’t be able to open new accounts, and even existing accounts will need one. Every naira that flows in will be monitored, taxed, and tracked. In plain words: there is no escape route.The Good Side of the ReformIf done right, this reform carries some positives:More money for schools, healthcare, and roads.Everyone, rich or poor, pays their fair share.Businesses that comply with tax laws gain credibility, better access to loans, and government contracts.Nigeria earns more respect globally with a working tax system.The Concerns We Can’t IgnoreStill, people are worried. And rightly so.Will the government spend the money well?Will there be double taxation from both federal and state authorities?Can struggling families and small businesses survive the added pressure?These questions remain. But instead of using them as excuses to dodge, Nigerians should demand accountability while still staying compliant.The Cost of Ignoring the LawThe government has been clear: ignorance is not an excuse. If you fail to comply, the penalties are heavy:Your bank accounts can be frozen.You may face huge fines.In cases of deliberate tax evasion, jail time is not off the table.What Nigerians Should Do Now2026 might look far, but it’s closer than you think. Start preparing now:Make sure your NIN is valid and active.If you run a business, ensure your CAC papers are in order.Keep proper records of your income and expenses.Don’t wait to be forced—comply early.Final WordThis tax reform is not just about the government; it’s about building a system that holds everyone accountable. It may be tough, it may be inconvenient, but it is inevitable.2026 is coming, and with it, a new era of taxation in Nigeria. The wise thing is to get ready before it meets you unprepared.

OJEDOKUN KEHINDE KINDNESS is a Software Engineer and IT Specialist with over 8 years of experience. He writes on technology, policy, and the intersection of governance and innovation.